WCOG

WisdomTree Enhanced Commodity UCITS ETF - USD

The WisdomTree Enhanced Commodity UCITS ETF - USD (the “Fund”) seeks to track the performance, before fees and expenses of the Optimised Roll Commodity Total Return Index (the "Index"). The Fund also aims to outperform the Bloomberg Commodity Index TR over the long term. The Fund invests in US Treasury Bills and uses total return swaps to deliver the Index performance. The swaps are collateralised on a daily basis and reset monthly. Learn more about the Index that WCOG is designed to track.

- Gain broad exposure to commodities as an asset class

- Potential to lower overall portfolio volatility in periods when commodities are negatively correlated with equities and bonds

- Innovative dynamic roll process designed to minimise long term costs of holding commodity exposures

Potential Risks?

- The returns payable on the Fund are dependent on payments received by the Fund from the swap counterparty under the terms of the relevant swap and therefore are subject to the credit risk of the swap counterparty

- The performance of commodity indices may differ significantly from spot commodity prices

- An investment in commodities may experience high volatility and should be considered as a longer-term investment

- Investment risk may be concentrated in specific sectors, countries, companies or currencies

- This list does not cover all risks-further risks are disclosed in the KIID and Prospectus

Overview

| Fund Overview | |

|---|---|

| Asset Class | Commodity |

| Use of Income | Distributing |

| Base Currency | USD |

| Inception Date | 27 Apr 2016 |

| Dividend Frequency | Annually |

| Exchange Ticker | WCOG |

| Index Name | Optimised Roll Commodity Total Return Index |

| TER | 0.35% |

| Annual Swap Rate | 0.35% |

| Structure | |

|---|---|

| Replication Method | US TBills With Swap Overlay |

| Legal Form | Irish Collective Asset-management Vehicle (ICAV) |

| Fund Umbrella | WisdomTree Issuer ICAV |

| Domicile | Ireland |

| Structure | Open-ended Exchange Traded Fund |

| Financial Year End | 31 December |

| UCITS Compliant | Compliant |

| Further Legal and Tax Information | |

|---|---|

| ISA | Eligible |

| SIPP | Eligible |

| UCITS Eligible | Eligible |

| Key Service Providers | |

|---|---|

| Custodian | State Street Custodial Services (Ireland) Limited |

| Administrator | State Street Fund Services (Ireland) Limited |

| Fund Manager | Assenagon Asset Management S.A |

| Auditor | Ernst & Young Ireland |

Listings & Codes

| Listings & Codes | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||

|

Benchmark Composition

Recent Distributions

| Recent Distributions | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||

|

||||||||||||||||

|

||||||||||||||||

|

Index Details

Optimised Roll Commodity Total Return Index

The Index is a US Dollar denominated index whose main objective is to provide a broad and diversified UCITS compliant commodity exposure, covering four broad commodity sectors: Energy, Agriculture, Industrial Metals and Precious Metals. The Index uses futures to track the performance of the individual constituents of the Bloomberg Commodity Index TR.The Index employs a rule based approach for each of its components when it 'rolls' from one futures contract to another for each commodity in the Index. Rather than selecting the new future based on a predefined schedule (e.g. monthly) the Index rolls to the future which generates the maximum implied roll yield. The Index aims to maximise the potential roll benefits in backwardated markets and minimise the loss from rolling down the curve in contango markets.

| Index Details | |

|---|---|

| Index Name | Optimised Roll Commodity Total Return Index |

| Index Provider | S&P |

| Bloomberg Ticker | EBCIWTT |

| Leverage Factor | N/A |

| Documents and Links |

|---|

| Security | 16 May 2024 |

|---|---|

| 1. Gold | 15.90% |

| 2. Brent Crude | 7.59% |

| 3. WTI Crude | 7.42% |

| 4. Copper (LME) | 6.10% |

| 5. Natural Gas | 5.75% |

| 6. Silver | 5.45% |

| 7. Soybean | 5.39% |

| 8. Corn | 5.10% |

| 9. Aluminum | 4.21% |

| 10. Live Cattle | 3.46% |

| 11. Soybean Meal | 3.37% |

| 12. Coffee | 3.14% |

| 13. Soybean Oil | 2.92% |

| 14. Nickel | 2.86% |

| 15. Gasoil | 2.85% |

| 16. SRW Wheat | 2.83% |

| 17. Zinc | 2.72% |

| 18. Sugar | 2.33% |

| 19. RBOB Gasoline | 2.23% |

| 20. ULS Diesel | 2.07% |

| 21. Lean Hogs | 2.00% |

| 22. HRW Wheat | 1.93% |

| 23. Cotton | 1.48% |

| 24. Lead | 0.90% |

Responsible Investing

SFDR Disclosure

The EU Sustainable Finance Disclosures Regulation (SFDR) took effect on 10 March 2021 as part of the EU Action Plan on Sustainable Finance. The SFDR lays down harmonised sustainability related disclosure rules for EU financial market participants and advisors and requires certain sustainability disclosures to be made for financial products which promote environmental or social characteristics (Article 8 SFDR) and funds which have a sustainable investment objective (Article 9 SFDR).

There are different SFDR product categorisations for these sustainability disclosure requirements:

+ Article 6 products: require disclosures relating to the manner in which sustainability risks are integrated into the decision-making process.

+ Article 8 products: promote, among other characteristics, environmental or social characteristics or a combination of those characteristics, provided that the companies in which the investments are made follow good governance practices.

+ Article 9 products: have sustainable investment as their objective

Please refer to EU regulation guidelines for more details: https://www.esma.europa.eu/sections/sustainable-finance

| SFDR categorisations | |

|---|---|

| SFDR Disclosure | Article 6 |

| Sustainability Characteristics | |

|---|---|

| MSCI ESG Fund Ratings (AAA-CCC) | N/A |

Collateral Details

Collateral Structure

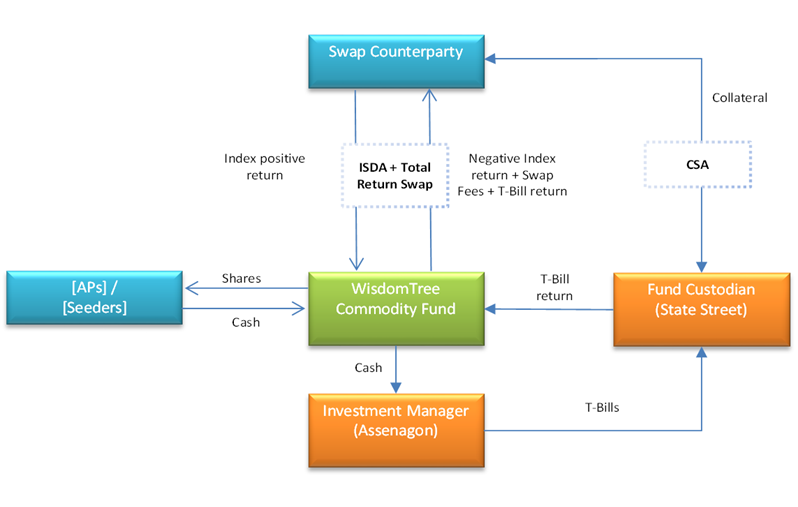

Replicating Exposure to Commodities Through a Swap

The fund aims to track the Optimised Roll Commodity Total Return Index (the “Index”) by holding a portfolio of short-terms US T-Bills and achieving exposure to commodities by entering into unfunded swap arrangements (“Swaps”) with highly rated swap counterparties. The Fund’s portfolio is composed of:

- A portfolio of 91-day US T-Bills acquired with subscription proceeds

- Swaps, passing the performance of the Index (from swap counterparties to Fund if performance is positive, the other way around if negative)

Structure Diagram

Counterparty Risk Management

Counterparty risk is managed mainly through the daily exchange of collateral between the fund and the swap provider(s). The value of the collateral required is based on a daily calculation of counterparty exposure using the prior day’s mark-to-market of the Swaps and any unsettled cash flowing between the fund and the swap provider.

Assets posted as collateral may only include cash (US Dollars only) or government bonds of US, UK, France or Germany, with a minimum rating of AA-/Aa3 (“eligible collateral assets”). When valuing the bonds posted as collateral, a haircut is applied to each bond's value based on the issuing country and the bond's maturity, as specified in the following table. Applying a haircut to the value of eligible collateral typically results in the collateral value exceeding the counterparty exposure and in any exposure being “over-collateralised”.

Haircuts / Over-Collateralisation Applied to Collateral Securities

DISCLAIMERS

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares ("Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.

The methodology of and rules governing the index (the "Index Methodology" and the "Index") are proprietary and shall not be reproduced or disseminated without the prior written consent of the “Index Sponsor” (as defined in the “Index Rules” available on http://www.wisdomtree.eu/home). None of the Index Sponsor, the index calculation agent (where such party is not also the Index Sponsor, the "Index Calculation Agent") nor, where applicable, the index Investment Advisor (the "Index Investment Advisor") guarantee that there will be no errors or omissions in computing or disseminating the Index. The Index Methodology is based on certain assumptions, certain pricing models and calculation methods adopted by the Index Sponsor, the Index Calculation Agent and, where applicable, the Index Investment Advisor, and may have certain inherent limitations. Information prepared on the basis of different models, calculation methods or assumptions may yield different results. You have no authority to use or reproduce the Index Methodology in any way, and neither the Index Sponsor nor any of its affiliates shall be liable for any loss whatsoever, whether arising directly or indirectly from the use of the Index or Index Methodology or otherwise in connection therewith. The Index Sponsor reserves the right to amend or adjust the Index Methodology from time to time in accordance with the rules governing the Index and accepts no liability for any such amendment or adjustment. Neither the Index Sponsor nor the Index Calculation Agent are under any obligation to continue the calculation, publication or dissemination of the Index and accept no liability for any suspension or interruption in the calculation thereof which is made in accordance with the rules governing the Index. None of the Index Sponsor, the Index Calculation Agent nor, where applicable, the Index Investment Advisor accept any liability in connection with the publication or use of the level of the Index at any given time. The Index Methodology embeds certain costs in the strategy which cover amongst other things, friction, replication and repo costs in running the Index. The levels of such costs (if any) may vary over time in accordance with market conditions as determined by the Index Sponsor acting in a commercially reasonable manner. The Index Sponsor and its affiliates may enter into derivative transactions or issue financial instruments (together, the "Products") linked to the Index. The Products are not in any way sponsored, endorsed, sold or promoted by the sponsor of any index component (or part thereof) which may comprise the Index (each a "Reference Index") that is not affiliated with BNP Paribas (each such sponsor, a "Reference Index Sponsor"). The Reference Index Sponsors make no representation whatsoever, whether express or implied, either as to the results to be obtained from the use of the relevant Reference Index and/or the levels at which the relevant Reference Index stands at any particular time on any particular date or otherwise.

No Reference Index Sponsor shall be liable (whether in negligence or otherwise) to any person for any error in the relevant Reference Index and the relevant Reference Index Sponsor is under no obligation to advise any person of any error therein. None of the Reference Index Sponsors makes any representation whatsoever, whether express or implied, as to the advisability of purchasing or assuming any risk in connection with the Products. The Index Sponsor and its affiliates have no rights against or recourse to any Reference Index Sponsor should any Reference Index not be published or for any errors in the calculation thereof or on any other basis whatsoever in relation to any Reference Index, its production, or the level or constituents thereof. The Index Sponsor and its affiliates shall have no liability to any party for any act or failure to act by any Reference Index Sponsor in connection with the calculation, adjustment or maintenance of the relevant Reference Index and have no affiliation with or control over any Reference Index or the relevant Reference Index Sponsor or the computation, composition or dissemination of any Reference Index. Although the Index Calculation Agent will obtain information concerning each Reference Index from publicly available sources that it believes reliable, it will not independently verify this information. Accordingly, no representation, warranty or undertaking (express or implied) is made and no responsibility is accepted by the Index Sponsor or any of its affiliates nor the Index Calculation Agent as to the accuracy, completeness and timeliness of information concerning any Reference Index. The Index Sponsor and/or its affiliates may act in a number of different capacities in relation to the Index and/or products linked to the Index, which may include, but not be limited to, acting as market-maker, hedging counterparty, issuer of components of the Index, Index Sponsor and/or Index Calculation Agent. Such activities could result in potential conflicts of interest that could influence the price or value of a Product.