3USL

WisdomTree S&P 500 3x Daily Leveraged

Why Invest?

- Gain a leveraged exposure to the performance of S&P 500.

- Magnify your returns in one simple trade.

- UCITS eligible and fully collateralised.

- Transparent performance and fees.

- Easy to invest: Everything in one product which does not require the investor to manage futures, borrow cash or short stocks.

- Risk Management: You cannot lose more than the amount invested.

- Liquidity: Trades on exchange, with multiple authorised participants (APs) and market makers (MMs).

Potential Risks

- An investment in an ETP involves a degree of risk. Any decision to invest should be based on the information contained in the relevant prospectus. Prospective investors should obtain independent accounting, tax and legal advice and should consult their professional advisers to ascertain the suitability of this ETP as an investment to their own circumstances.

- This ETP is structured as a debt security and not as shares (equity) and can be created and redeemed on demand by authorised participants and traded on exchange just like shares in a company. This ETP is not a UCITS product.

- Investing in Short and Leveraged ETPs is only suitable for sophisticated and or informed investors who understand leverage, daily rebalancing and compounded daily returns and are willing to magnify potential losses. Short and Leveraged ETPs are only intended for investors who understand the risks involved in investing in an ETP with short or leveraged exposure and who intend to invest on a short term basis. Any investment in a short or leveraged ETP should be monitored on a daily basis to ensure consistency with your investment strategy. You should understand that investments in daily leveraged ETPs held for a period of longer than the recommended holding period of one day, may not provide returns equivalent to the return from the relevant unleveraged investment multiplied by the relevant leverage factor over the same period. Daily compounding may result in returns which an investor may not expect, if the investor has not fully understood how a daily leveraged ETP works. Potential losses in leveraged ETPs may be magnified in comparison to investments that do not incorporate leverage. In extreme volatility, returns of leveraged ETPs, even over one day, may under-perform the return of the underlying unleveraged index multiplied by the ETP’s leverage factor because of protection mechanisms within the ETP structure, intended to protect against intra-day market crashes. For more information see here: https://www.wisdomtree.eu/en-gb/resource-library/short-and-leveraged-centre

- Market Risk: The value of securities in this ETP is directly affected by increases and decreases in the value of the Index. Accordingly, the value of a security may go up or down and a security holder may lose some or all of the amount invested but can not lose more than the amount invested.

- Liquidity risk: There can be no certainty that securities can always be bought or sold on a stock exchange or that the market price at which the securities may be traded on a stock exchange will always accurately reflect the performance of the Index.

- Currency Risk: The price of securities in this ETP is generally quoted in USD. To the extent that a security holder purchases securities in another currency, the value will be affected by changes in the exchange rate.

- Counterparty risk: The Issuer is reliant on there being swap counterparties available to enter into swap agreements on a continuing basis and, if no swap counterparties are willing to do so, the ETP will not be able to achieve its investment policy of tracking the performance of the Index.

- Credit Risk: The Issuer is subject to the risk that third party service providers may fail to return property or collateral belonging to the Issuer or pay money due to the issuer. The ETP is backed by swaps. The payment obligations of the swap counterparties to the Issuer are protected by collateral held which is marked to market daily. The collateral is held in segregated accounts at The Bank of New York Mellon. In the event a swap counterparty defaults, the proceeds from realisation of the collateral may be less than what the investor expects. Details of the collateral held can be found in the Collateral section of the WisdomTree website (www. Wisdomtree. Com).

- Please see the risks factors section of the Prospectus for a more detailed discussion of the potential risks

Overview

| Fund Overview | |

|---|---|

| Base/Trading Currency | USD/USD |

| Bloomberg Ticker | 3USL LN |

| Index Bloomberg Ticker | SPTR500N |

| Index Name | S&P 500 Net Total Return |

| ISIN | IE00B7Y34M31 |

| Leverage Factor | 3x |

| Structure | |

|---|---|

| Physical Assets | Yes (Collateral) |

| Structure | ETP |

| Domicile | Ireland |

| Replication Method | Fully Collaterised Swap |

| Further Legal and Tax Information | |

|---|---|

| ISA | Eligible |

| SIPP | Eligible |

| UCITS Eligible | Eligible |

| UK Fund Reporting Status | Yes |

| Key Service Providers | |

|---|---|

| Issuers | WisdomTree Multi Asset Issuer PLC |

| Administrator | Apex IFS Limited |

| Custodian | Bank of New York Mellon |

| Trustee | Law Debenture Trust |

| Auditor | Deloitte LLP |

| Swap Provider | BNP Paribas Arbitrage SNC |

| Market Makers | Market Makers |

| Authorised Participants | APs |

| Fees | |

|---|---|

| Annual Management Fee Rate | 0.75% |

| Daily Swap Rate | 0.002330% |

| Restrike | |

|---|---|

| Product intraday restrike threshold | 20% |

| Severe overnight gap event threshold | 25% |

| Product restrike information | Product Restrike Information |

Adverse price movements intraday or overnight can quickly and significantly reduce the value of a leveraged ETP, sometimes to zero. Understanding restrike arrangements is essential to understanding a key product risk.

Listings & Codes

| Listings & Codes | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

|

Performance

| Product | |

|---|---|

| Month-To-Date (mtd) | -3.01% |

| Year-To-Date (ytd) | 36.06% |

| 1 Year | 47.46% |

| 2 Year | 88.79% |

| 3 Year | 22.30% |

| 4 Year | 199.80% |

| 5 Year | 151.82% |

Index Details

S&P 500 NET TOTAL RETURN INDEX

The S&P 500 Index is a market capitalization-weighted index representing large cap US equities, which is designed to measure the performance of 500 leading companies in the US economy. The S&P 500 Net Total Return version of the index reflects the effects of dividend reinvestment after the deduction of withholding tax.

| Index Details | |

|---|---|

| Index Name | S&P 500 Net Total Return |

| Currency | USD |

| Index Provider | S&P |

| Bloomberg Ticker | SPTR500N |

| Reuters Index Ticker | .SPXNTR |

| Leverage Method | No Leverage |

| Documents and Links |

|---|

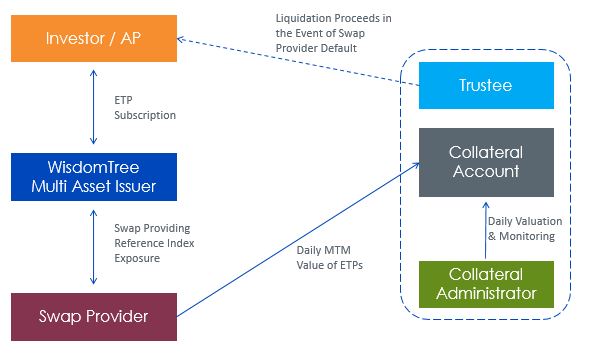

Collateral Details

| Collateral Details | 23 Jul 2024 |

|---|---|

| Collateral Coverage Ratio | 95.1% |

| Collateralised | Yes |

| Over Collateralised | Yes |

| Custodian | Bank of New York Mellon |

Collateral Structure

Documents

Historical Data

WisdomTree Multi Asset Issuer PLC (the “Issuer”) issues products under a Prospectus (“WTMA Prospectus”) approved by the Central Bank of Ireland, drawn up in accordance with the Directive 2003/71/EC. The WTMA Prospectus has been passported to various European jurisdictions including the UK, Italy and Germany and is available on this document.

WisdomTree Multi Asset Issuer PLC Exchange Traded Products (“ETPs”) are suitable for financially sophisticated investors who wish to take a short-term view on the underlying indices and can understand the risks of investing in products offering daily leveraged or daily short exposures.

ETPs offering daily leveraged or daily short exposures (“Leveraged ETPs”) are products which feature specific risks that prospective investors should understand before investing in them. Higher volatility of the underlying indices and holding periods longer than a day may have an adverse impact on the performance of Leveraged ETPs. As such, Leveraged ETPs are intended for financially sophisticated investors who wish to take a short-term view on the underlying indices and understand such risks. As a consequence, WisdomTree is not promoting or marketing WisdomTree Multi Asset Issuer PLC ETPs to retail clients. Investors should refer to the section entitled "Risk Factors" and “Economic Overview of the ETP Securities” in the WTMA Prospectus for further details of these and other risks associated with an investment in Leveraged ETPs and consult their financial advisors as needed. Neither WisdomTree, nor the Issuer has assessed the suitability of any Leveraged ETPs for investors other than the relevant Authorised Participants.

The "S&P 500 Index” is a product of S&P Dow Jones Indices LLC or its affiliates ("SPDJI') and has been licensed for use by WisdomTree Multi Asset Management Limited (“WTMA”). Standard & Poor's® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P") and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). The trademarks have been licensed to SPDJI and have been sublicensed for use for certain purposes by WTMA. The ETP is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, any of their respective affiliates (collectively, "S&P Dow Jones Indices"). Neither S&P Dow Jones Indices nor any third party make any representation or warranty, express or implied, to the owners of the ETP or any member of the public regarding the advisability of investing in securities generally or in the ETP’s particularly or the ability of the S&P 500 Index to track general market performance. S&P Dow Jones Indices only relationship to WTMA with respect to the S&P 500 Index is the licensing of the S&P 500 Index and certain trademarks, service marks and/or trade names of S&P Dow Jones Indices and/or its licensors. The S&P 500 Index is determined, composed, and calculated by S&P Dow Jones Indices without regard to WTMA or the ETP. S&P Dow Jones Indices have no obligation to take the needs of WTMA or the owners of the ETP into consideration in determining, composing, or calculating the S&P 500 Index. Neither S&P Dow Jones Indices nor any third party are responsible for and have not participated in the determination of the prices, and amount of the ETP or the timing of the issuance or sale of the ETP or in the determination or calculation of the equation by which the ETP is to be converted into cash, surrendered, or redeemed, as the case may be. S&P Dow Jones Indices have no obligation or liability in connection with the administration, marketing, or trading of the ETP. There is no assurance that investment products based on the S&P 500 Index will accurately track S&P 500 Index performance or provide positive investment returns. S&P Dow Jones Indices LLC is not an investment advisor. Inclusion of a security within an S&P 500 Index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, nor is it considered to be investment advice.

NEITHER S&P DOW JONES INDICES NOR ANY THRID PARTY GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE S&P 500 INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY WTMA, OWNERS OF THE ETP, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P 500 INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HA VE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND WTMA, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.