Is Turkey ripe for change after the “perfect storm”?

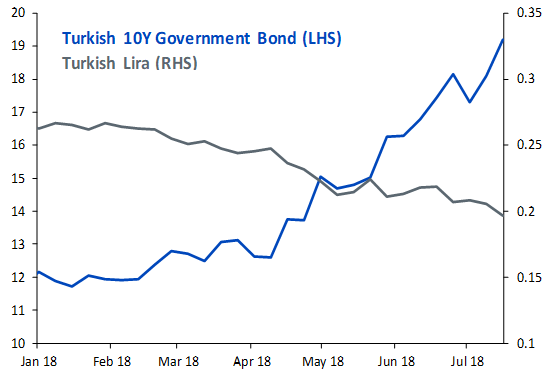

Markets are reflecting strong concerns over the stewardship of President Erdogan in the wake of the imposition of US sanctions. This is causing the Turkish Lira to depreciate further and its benchmark bond yields to hit historic highs.

The Turkish Lira (-28.2%1) has been the second worst performing emerging market currency this year fuelling inflation to its highest level in 15 years. Yields on Turkey’s 10-year local currency bonds reached 20.09%2 compared to 13.7%3 just 3 months ago.

Figure 1: Deepening crisis in Turkey? Benchmark bond yields vs Turkish Lira

Source: Bloomberg, WisdomTree, data available as of close 07 August 2018.

Historical performance is not an indication of future performance and any investments may go down in value.

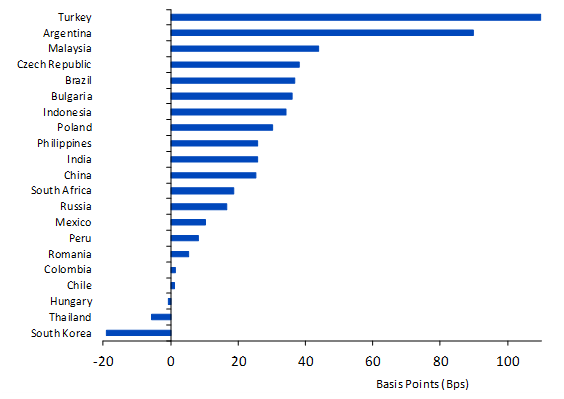

The cost of insuring exposure to Turkish debt reflected by the 5-year credit default swaps has risen 109.8%4 since the start of the year. It is the highest across emerging markets, signifying deepening concerns of an overheating economy.

Figure 2: Credit default swap spreads

Source: Bloomberg, WisdomTree, data available as of close 07 August 2018.

The Turkish economy seems even more vulnerable owing to its unsolved macroeconomic imbalances. Its current account deficit is the widest among Emerging Markets and inflation levels are nearly three times the central bank’s target. Turkeys excessive investment growth is deeply rooted in the construction sector. According to data from the Central Bank of the Republic of Turkey (CBRT), companies hold US$337Bn of foreign exchange liabilities, with a shortfall of US$217.3Bn net against assets5. Banks are exposed to higher borrowing costs as nearly US$100Bn worth of debt is expected to mature over the course of a year.

At the start of the week, the CBRT boosted the banks’ access to US Dollar liquidity by US$2.2Bn, however it was insufficient to stem the Lira’s losses. Since then, we have seen no call of action from either the government or the Central Bank, but we expect to see a shift in monetary policy, tighter fiscal policy and support from the International Monetary Fund (IMF) to help reverse the tide. The perception from the investment community is that monetary policy in Turkey is not independent as President Erdogan is opposed to higher interest rates, so the CBRT would need to defy the president and raise rates to defend the currency and avoid a potential default scenario.

Confrontation with US amplifies Turkeys problems

On August 1, 2018 the US imposed sanctions on two Turkish officials over the arrest and detention of American pastor Andrew Craig Brunson who is being tried for terror-related charges. The American pastor was purported by the Turkish government as one of the key orchestrators of the military coup that failed in 2016. The sanctions targeting Justice Minister Abdulhamit Hul and Interior minister Suleyman Soylu freeze any property or assets on US soil held by them and bar US citizens from engaging in financial transactions with them.

Since then, tensions have flared up between the two NATO allies. While the US was originally planning to impose more damaging sanctions and demand the release of four more political hostages, it has now dialled back its aggressive stance as it does not want to be made responsible for a broader crisis. According to the foreign ministry in Ankara, it appears that Washington and Ankara are close to reaching a preliminary understanding on certain matters concerning the sanctions, however details on the matter remain scant.

Investors in Emerging Markets tend to be opportunistic and likely to take advantage of this type of situation. While it’s hard to predict which path Turkey will take, so far we don’t expect the contagion effect spreading across other Emerging Market countries, as Turkey accounts for less then 1% of the MSCI Emerging Market Index.

1 As on 08 August 2018.

2 As on 08 August 2018.

3 As on 09 May 2018

4 As on 07 August 2018.

5 Source: Bloomberg